Layer 3 Underwriting Memo

Project Background / History

Layer3 is a platform designed to enhance user engagement within the Web3 ecosystem by connecting users with blockchain protocols through innovative reward systems. Co-founded by CEO Dariya Khojasteh and Brandon Kumar, the company aims to make complex blockchain technology more accessible and incentivize active participation.

Fundraise History: In June 2024, Layer3 secured $15 million in a Series A funding round valued at $140mm FDV, co-led by ParaFi and Greenfield Capital, bringing its total funding to $21.2 million since 2021.

Bull

Bear

Porters 5 Forces

Threat of Suppliers (Weak): Layer3's users are given access to exclusive incentive campaigns that pay them to participate. There isn't much collective bargaining power due to limited user concentration.

Threat of Buyers (Weak): Layer3 has a differentiated product offering and doesn't have significant customer concentration. Layer3 is paid in tokens, which teams typically are less price sensitive about relative to cash spend.

Competitive Rivalry (Strong): Galxe, Zealy, and Intract have competitive offerings, good customer reviews, and strong teams. Each company has enough market share to stay relevant and is well funded. Most RFPs are competitive and teams issuing incentives shop around prior to committing.

Threat of New Entrants (Weak): Startups would have a hard time building a brand and gaining enough users to build the network effects necessary to compete. Enterprise customers want to access a platform's existing distribution, and having a sizable user base is necessary. Companies with existing users could potentially compete, but there are few companies in the market with the ability.

Threat of Substitutes (Medium): Layer3 is competing for a portion of a company's marketing spend. A company has the ability to engage in traditional marketing routes like social media advertising, it can in-house a token incentive program, or it can use syndicates and TVL incentive providers like Royco and Turtle Club to increase awareness and usage of its products.

Helmer's 7 Powers

Network Economies (Strong): Enterprise customers want to access an incentive provider's existing distribution channels. Layer3's enterprise offering is more compelling to customers as it grows its userbase. Each marginal enterprise customer inevitably brings some of its own users to the Layer3 platform, and some of them are sticky and become users of other enterprise customers. Relatedly, an increase in the amount of incentives and quests available should lead to user growth.

Switching Costs (Weak): Enterprise customers have an upfront cost to campaigns and are unlikely to churn during the period of their campaign. There's limited customer lock-in after a campaign concludes.

Branding (Strong): Layer3's long list of well known brands as existing customers act as a testament to the quality of its product offering. Marginal potential customers recognize Layer3's offering as the highest quality on the market due to the case studies and references that Layer3 provides.

Process Power (Medium-Strong): Layer3 has built a significant number of synergistic product offerings that increase user stickiness and the value proposition to enterprise customers. For example, many of Layer3's clients operate chains and require users to bridge capital to the chain to participate in its incentive offerings. Layer3 added a cross-chain swap widget to allow users to natively bridge without leaving the Layer3 website.

Layer3 KPIs

Layer3 vs. Galxe

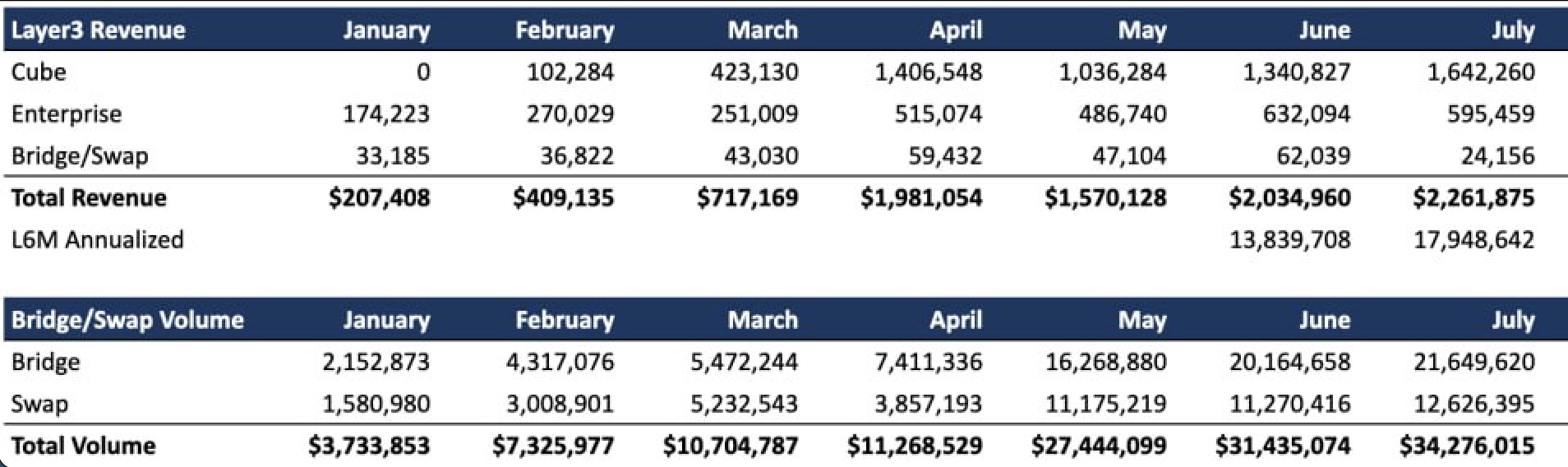

Monthly Revenue Breakdown

Enterprise Revenue TAM Analysis

Financial Model

Appendix

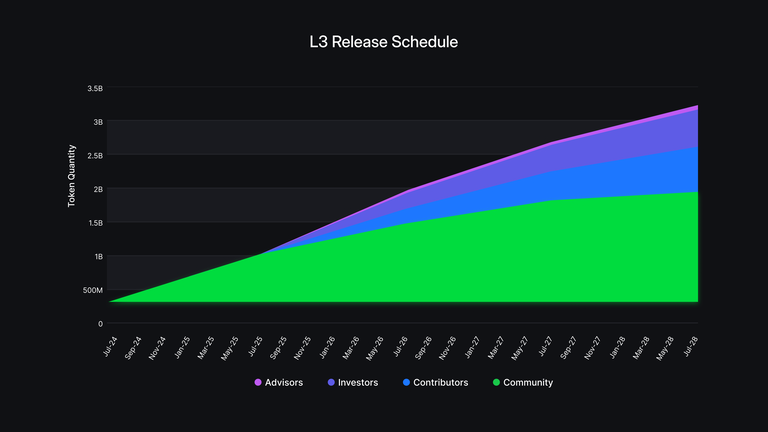

Token Distribution and Vesting

Staking Model: can lock stake for a larger % of total emissions. Staking yields are primarily from token inflation. We can anticipate staking rewards of 10-30% for the first year depending on whether we lockup our tokens for 1 year

Competitors